This series of blog posts will talk about (in no particular order) what Accounting for Dentists is, who it’s for, why I decided to write my own app, and some of the initial design decisions I made in releasing the first public release. This blog post talks about what Accounting for Dentists is.

Other blog posts in this series:

- To All the Tax Apps My Wife Has Used Before

- What is Accounting for Dentists

- Cloud vs Self-Hosting (TBD)

- Data Security (TBD)

- Database decisions (TBD)

Accounting for Dentists is a cross-platform web application that aims to simplify record keeping. It is not designed to be a replacement for an accountant, and it is purposely minimalist. It serves one purpose, and one purpose only: make record keeping for dentists easier. You’ll still need an accountant, but you probably won’t need their help for entering your BAS.

With these ideals in mind, I set out to create Accounting for Dentists for my wife. I also figured that if it helps my wife, it’ll probably help others too who are in the same boat. Some of my requirements were:

- Accessible from anywhere on any device – My wife wanted to be able to use it on her laptop, and her phone, and her tablet, all at the same time.

- Secure by default – As a consequence of being accessible from anywhere, the data needed to live on a public server. I wanted the data to be encrypted such that only the owner of the data could decrypt it.

- Private – the app does not store any personally identifiable information about users. Any potentially personally identifiable information that is stored (such as invoices, or income descriptions) is encrypted and can only be decrypted by the user. Also, no ads, no user tracking.

- For Dentists – My primary user (my wife) is a dentist. So, I want the application to cater specifically for her (and consequently, other dentist’s) use cases. This means that features that specifically target the business use-case of dentists are implemented. The features are more specific, less general.

For my wife, this means she can:

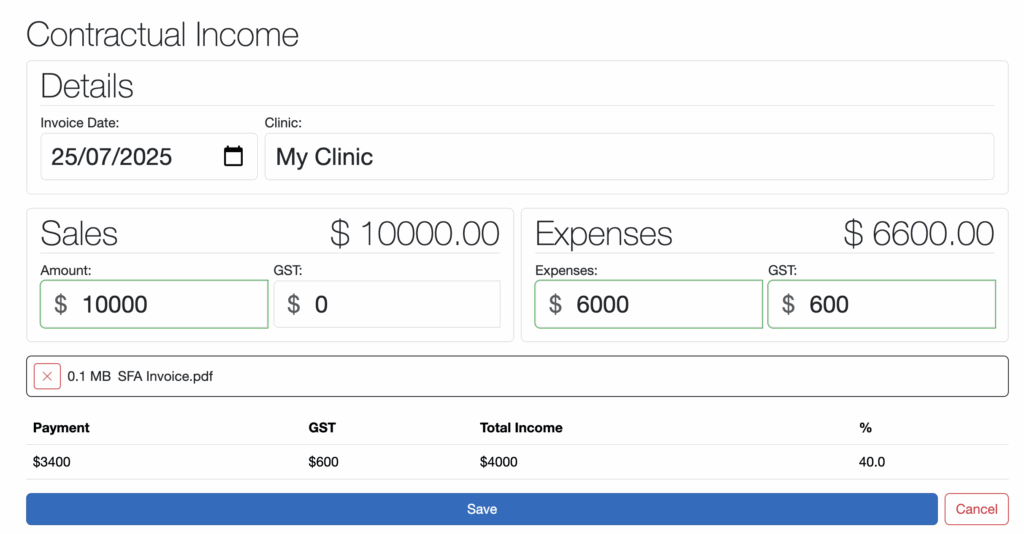

- Enter her SFA income in one shot.

- Enter her commission income as an sale.

- Enter her business purchases as expenses.

- Add invoices to her sales and expenses for tracking (and SFA income).

- See her overall sales, expenses, and income, for the financial year.

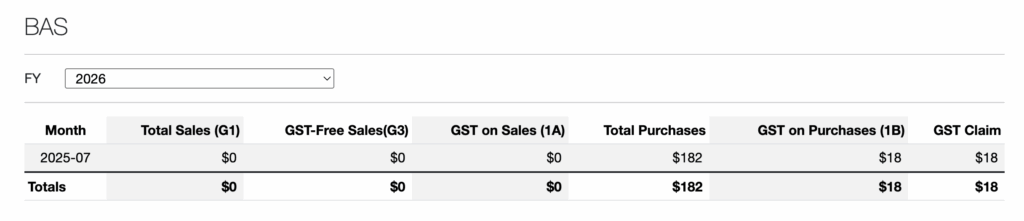

- Have all her BAS data in one place for easy entry in the ATO website.