This series of blog posts will talk about (in no particular order) what Accounting for Dentists is, who it’s for, why I decided to write my own app, and some of the initial design decisions I made in releasing the first public release. This blog post talks about what Accounting for Dentists is.

Other blog posts in this series:

- To All the Tax Apps My Wife Has Used Before

- What is Accounting for Dentists

- Cloud vs Self-Hosting (TBD)

- Data Security (TBD)

- Database decisions (TBD)

Before starting on this journey, my wife had used a number of approaches to managing her tax affairs (there were many, believe me). They all started out great with much promise, but eventually familiarity bred resentment and that promise turned foul.

So, I’d like to take a minute, just sit right there, I’ll tell you about what my wife went through for her tax affairs.

Google AppSheet

My first go at helping my wife was with an app written using Google AppSheet. Google AppSheet is a low-code platform that allows anyone (literally, it’s quite intuitive and beginner-friendly) to create a facade for a spreadsheet with some pretty forms and views for data contained in a spreadsheet.

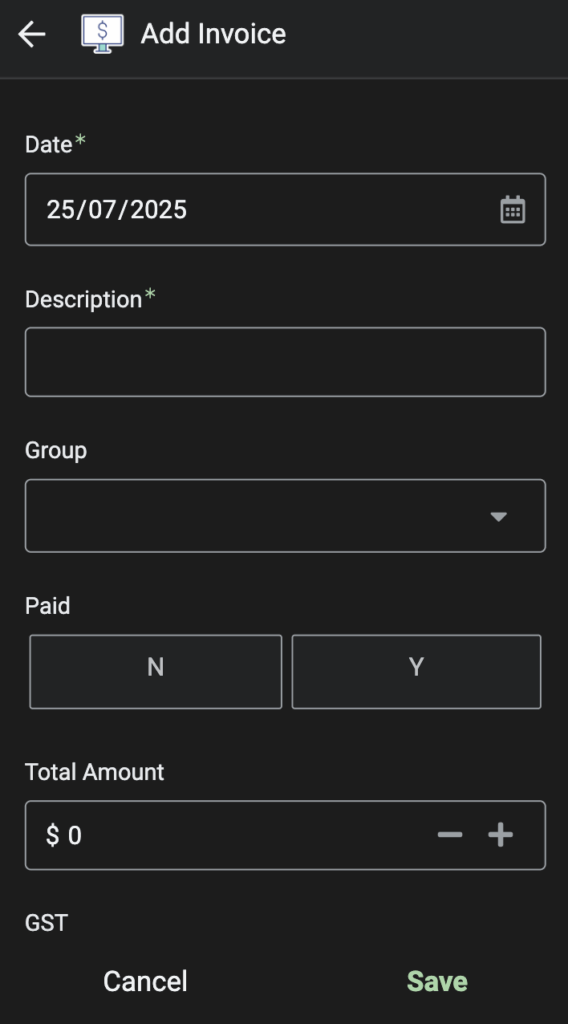

The app (which I christened Tax App) had some basic functionality to cater for my wife’s main accounting needs: BAS (Business Activity Statement); Invoices for purchases; Management Fee (for Services and Facility Agreements); a section for capturing invoices that hadn’t been paid yet; and a financial-yearly aggregate to give an idea of total net income.

This was a cross-platform solution, and my wife could use it on her laptop, phone, tablet, whichever was most convenient for her at the time. Over time, feature requests began flooding in – adding additional data points, reworking the logic, and the limitations of the system began to show. Once data decisions were made, it became increasingly difficult to change things. Eventually, the app became complicated enough that entering data became a chore that was easier left undone. Slowly, she stopped keeping Tax App up to date, and eventually stopped using it altogether.

MYOB Solo

In her quest to find another app to solve her record-keeping problem, she turned to the main contenders in this space, MYOB and Xero. These were prohibitively expensive for her simple use case – both started at $35/month for the cheapest subscription (with cheaper temporary new-customer offers).

MYOB had another option – MYOB Solo at $11/month (with a bonus offer of $12 total for the first year). Enticed by this low-cost offering, she tried MYOB Solo. The app was designed for sole-traders. She was a sole-trader. It seemed like a match made in heaven. But like any relationship, little things that seemed cute and helpful at the start started to feel like frustrating limitations – like only being able to use the app on her phone or tablet, not her laptop where she dealt with most of her emails. The app was designed for sole-traders in mind, but the kind of sole-trading dentists do is different, depending on their employment arrangements.

Entering SFA income became a two-step process – entering in income as the total sales, and then entering in the SFA cost as an expense. Not a deal-breaker, but enough friction to make it unnecessarily complicated.

She had some other issues too with expenses not appearing correctly (this is second-hand information from her), but if I’m being honest, they were probably caused by not reading the app instructions.

They were probably caused by not reading the app instructions – that’s an interesting statement. An app of this nature shouldn’t need reading instructions. It should be blindingly obvious how to correctly use it, especially for simple cases of money in, money out.

Excel Spreadsheet

Giving up hope, I created a simple spreadsheet where she could enter in income for the practices she worked at, and also record expenses in a worksheet. This was by far the most simple solution, and it would have worked well, but it required storing invoices separately, and when it came time to double-check all the tax information for the financial year, became just that little bit harder to correlate the information. I would have the spreadsheet open on my laptop, while she would read out invoice numbers from her laptop. It also didn’t lend itself nicely to presenting the data in a nice and easily-digestible format.

Accounting for Dentists

Eventually, I knew I had only one option – create an app that would cater to her needs. You won’t believe what happens next. I created an app that would cater to her needs. Stay tuned for the next instalment in this blog series: What is Accounting for Dentists.

Leave a Reply